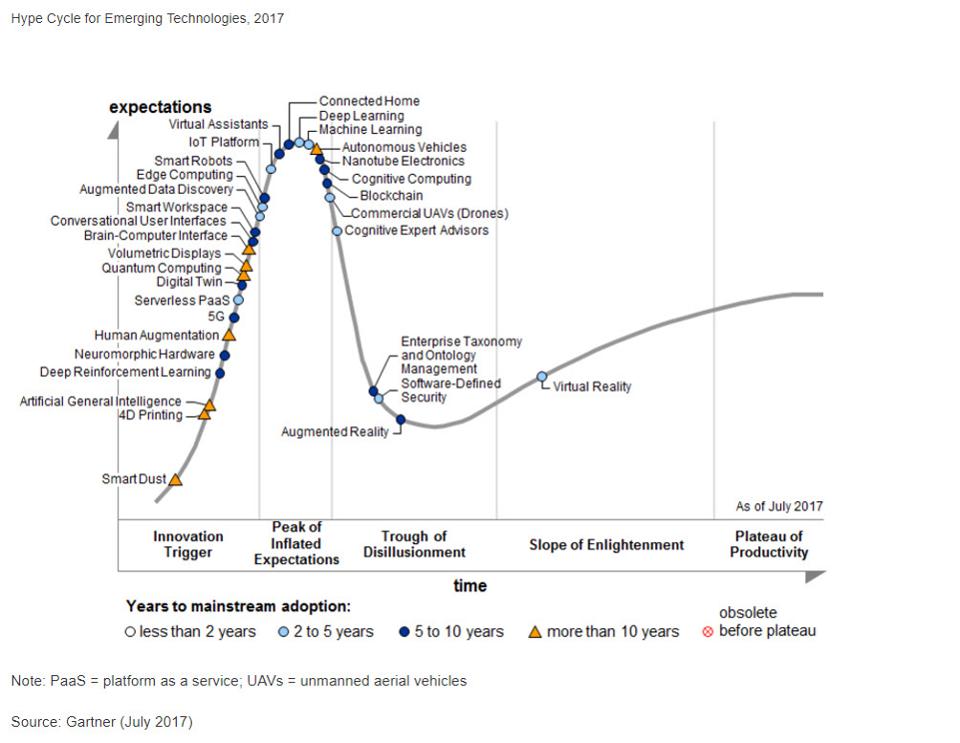

A useful infogram detailing the current state of a huge number of emerging technologies in what has ben called the ‘hype cycle’ :

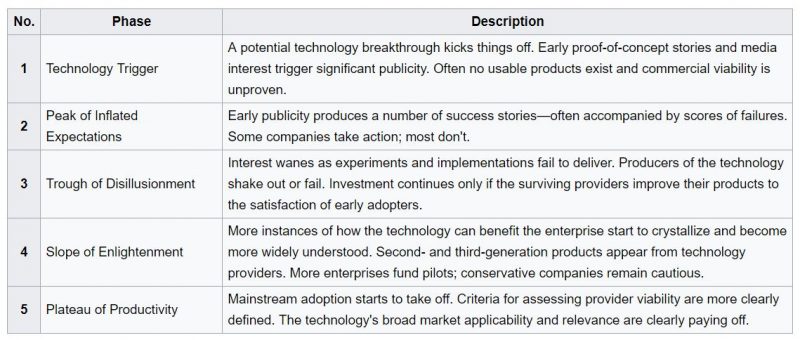

The graphic comes from market research firm Gartner, who coined the term ‘hype cycle’, or at least gave it some detailed analysis, by breaking it down into five component parts.

Being able to spot the point at which a technology is currently in in its respective hype cycle is clearly a potential lucrative way to make money from investing in companies invovlved in that technology. 3D printing and solar technology are two recent examples of technologies in which the hype and expectations got way ahead of actual productive use, which created inflated bubbles in the stock prices of the leading tech companies involved in those tech sectors. This led to inevitably spectacular collapses in stock values when the bubble inevitably burst as expectations became more realistic (and investors rushed to sell). Many say that Bitcoin and other cryptocurrencies are near the peak of a bubble.

The hype cycle and its relation to stock price can clearly be seen in the fortunes of leading 3D printing firm ‘3D Systems (DDD)’. It, long with the 3D printing industry in general, appears to be gingerly edging back up the ‘slope of enlightenment’ after a spectacular fall from the peak at the end of 2013 (although the stock price of 3D printing stocks have taken another tumble in recent weeks).

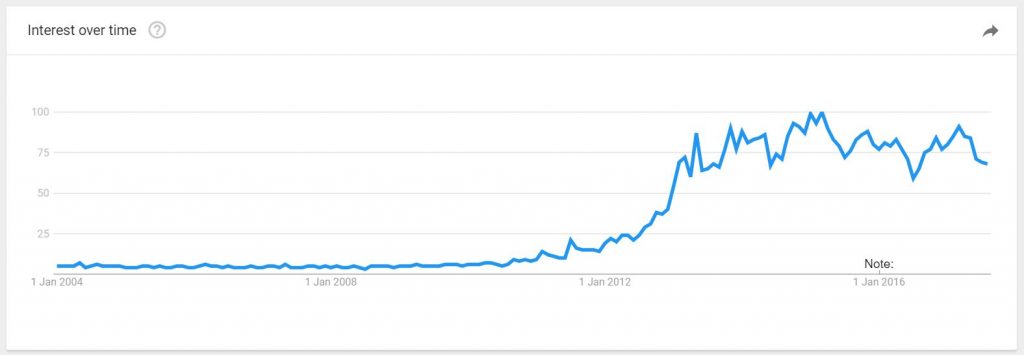

Compare the above with a Google Trends chart that measures search interest since 2004 for 3D printing (people typing ‘3d printing’ into Google) :

Although the Google Trends chart does not exactly mirror the rise and fall in the stock price of 3D Systems, it reflects it fairly closely, and an intelligent analyst would be able to spot the sign that 3D printing was at its peak of hype at the turn of 2013/2014. Although search interest was marginally higher by the end of 2014, in early 2014 it had dropped much more than in previous Januarys (after the holiday season/CES spikes).

I remember having an inkling of the 3D Printing stock bubble crash at the start of 2014, when 3D Systems along with other leading players in the industry were showcasing their latest tech at the annual Consumer Electronics Show (CES) in Las Vegas. In recent years, I’d noticed that the stock price would jump up even further as media attention was directed again at the ‘next trillion dollar industry’ that was going to change the world and be in everybody’s homes by the following Christmas. However, this time, the stock price remained steady and even fell a little. At that moment I sensed that this might indeed be a bubble about to burst and that 3D printing stocks had reached their peak. Unfortunately, I was neither an experienced investor at that point, nor did I have the courage to trust my instincts, and thus I only finally started selling my 3D stocks later that year as the price kept falling (I still made a handsome profit, and I still have about 50% of my original holdings in 3D Systems and Stratasys (SSYS)). However, if I had transferred most or all of my 3D printing stock at that time into another emerging tech – such as Bitcoin – that was further back in the hype cycle, then my original investments that I made for less than $20K, and that at that point were worth nearly $150k, would now be worth in the millions of dollars.